Wintershall DEA: Successful by tradition LetterOne and BASF signed agreement to merge DEA and Wintershall

- Creation of the largest independent European exploration and production company

- Closing of transaction expected in the first half of 2019

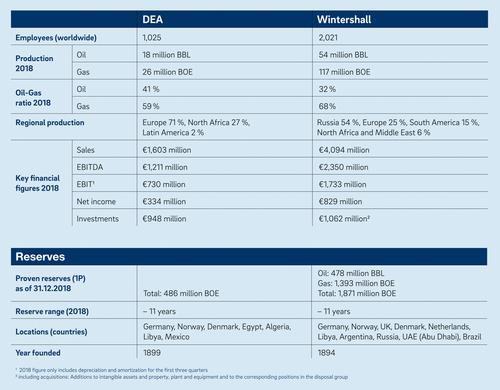

LetterOne and BASF signed a definitive transaction agreement to merge their respective oil and gas businesses. The joint venture will operate under the name Wintershall DEA. With Wintershall DEA the leading independent European exploration and production company with international operations in core regions is created. In 2017, pro-forma hydrocarbon production of DEA and Wintershall totaled 210 million barrels of oil equivalent (BOE); this equals a production of around 575,000 BOE per day. By combining the two German-based entities, LetterOne and BASF lay the basis for further profitable growth. In the medium term, LetterOne and BASF envisage to list Wintershall DEA through an Initial Public Offering (IPO).

Here you can read the press release by LetterOne.

Closing of the transaction is expected in the first half of 2019, subject to customary regulatory approvals. Until closing, DEA and Wintershall will continue to operate as independent companies.

Through Wintershall DEA, DEA and WIntershall will together continue their successful growth strategies of the previous years. DEA has increased its production by 24% in the past three years, from 37 million boe in 2014 to 46 million boe in 2017. In the same period, DEA’s proven reserves (1P) jumped by almost 80%, to 508 million boe. In the past eleven years, Wintershall has increased its production by over 50%, from 111 million boe in 2006 to 164 million boe in 2017. During that time, Wintershall doubled its proven reserves (1P) to 1.7 billion boe.

“With the planned merger, we will continue DEA’s successful path of recent years and unleash further growth potential”, said Maria Moraeus Hanssen, Chief Executive Officer of DEA Deutsche Erdoel AG. “The combination of DEA and Wintershall will create the leading independent European exploration and production company. This will open more opportunities and will facilitate further growth so that we can compete at the highest level. This is a great moment for DEA, for our people and for the energy industry.” As largest independent oil and gas producer in Europe, Wintershall DEA’s technical expertise and high flexibility will allow it to respond to changes in the energy market quickly in future.

Wintershall DEA – shaping the future together

DEA, and Wintershall the two long-standing German companies that are about to merge, are a perfect match for each other. Wintershall, established in Kassel back in 1894, initially for mining potassium salt. DEA, founded in Nordhausen/Thuringia in 1899, as “Deutsche Tiefbohr-Actiengesellschaft” for mining potassium salt as well. In the course of their over 100-year histories, both companies have developed extremely successfully and strategically optimized their portfolios.

From 1988 to 2015, DEA was a subsidiary of RWE, before it became part of the Luxembourg-based LetterOne in 2015. Originally, DEA also had a network of filling stations and refineries, which was taken over by Royal Dutch Shell in 2002. Wintershall has been part of BASF in Ludwigshafen since 1969. BASF’s acquisition immediately made Wintershall BASF’s largest European subsidiary.

After closing of the transaction, DEA and Wintershall, two companies steeped in tradition, will then share a future together,

Videos

- DEA and Wintershall envisage to create the leading European oil and gas company .